Magento is a superbly powerful ecommerce platform, but it is a learning curve. Some of the more confusing areas are the Tax Rates / Rules sections.

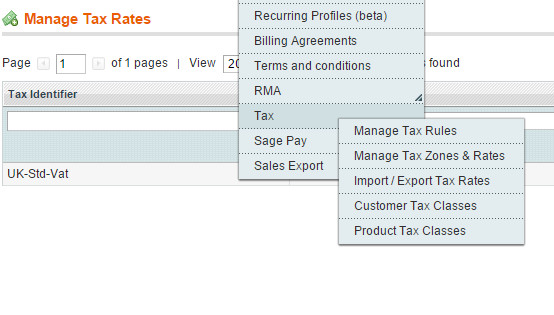

Your first port of call should be the Manage Tax Zones & Rates section under Sales -> Tax.

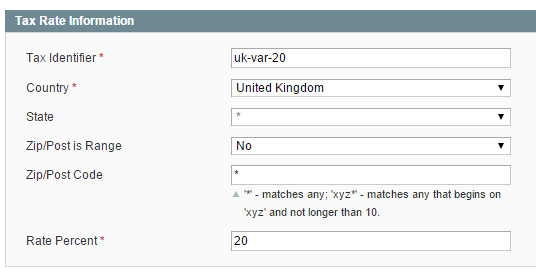

Once in this section, click the Add New Tax Rate button and fill out the relevant information as below (tax identifier can be whatever you like – but we suggest something that makes it obvious its the uk vat rate) Click save once you have finished:

After you have created your tax rate we need to make a matching tax rule so that the new rate can be applied. Click into Manage Tax Rules, and then click the Add New Tax Rule button.

In the new box, give your tax rule a name, then select appriate customer tax classes (usually Retail Customer), product tax classes (usually taxable goods and shipping), and the tax rate you made earlier. Now click save rule.

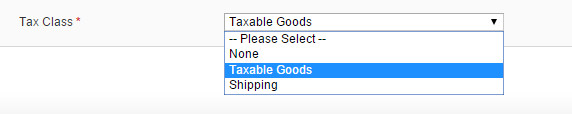

To give a product VAT, select the tax class Taxable Goods when editing your product from Catalog -> manage products.

After a product has been given tax, it’s important to doublecheck your tax display settings in System -> Configuration -> Sales -> Tax. The most common setting that we have to tweak is whether or not the products have been entered into the catalog inclusive or exclusive of vat (forgetting to set this correctly could mean you charge too much vat).